(Editor’s Note: Sarah Marion will present “A Mile in Their Shoes: Exploring Gym Members’ Holistic Approaches to Fitness,” at the Club Industry Executive Summit Nov. 8-10, 2021, in Nashville. Find out more about the event and register here.)

There’s little doubt COVID-19 has substantially impacted most Americans’ everyday lives, including how and where they exercise. Although some assumed (and hoped) these changes might be short-lived, as the pandemic continues to rage, it’s clear that enduring trends are emerging that could impact the fitness industry for the foreseeable future. Data from State of Our Health, an ongoing fitness and food tracker, sheds light on these trends and what they might mean for gyms, clubs and fitness studios moving forward.

Americans' Fitness Habits

On the one hand, about a quarter of health-engaged Americans reported having more time to work out, especially among men, Gen Z and Millennials. On the other hand, 28 percent felt less energetic and motivated to exercise, especially women and older consumers. Interestingly, men, Gen Z and Millennials were significantly less likely to have stopped working out at gyms compared to women and older consumers. The loss of the gym may have contributed to women’s and older consumers’ higher levels of exercise apathy and to poorer mental health outcomes, with 35 percent of health-engaged women reporting that their mental health suffered during the pandemic compared to 24 percent of men.

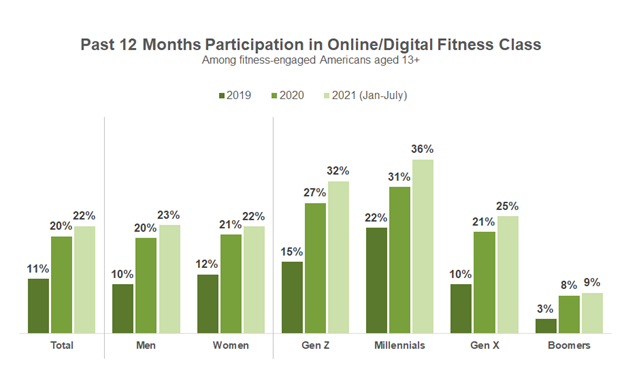

To complicate matters, younger consumers were also more likely to have invested in at-home fitness adaptations and to have increased their use of online/digital fitness. And use of online/digital fitness has continued to grow as we move through 2021, even as consumers slowly return to gyms and fitness studios. This highlights that digital fitness is now an established part of consumers’ workout routines, especially high-value, active, young consumers for whom fitness is a priority. More about them in a moment.

Complications

The latest COVID surge complicates the return to in-person fitness, especially for women and older consumers.

If you’re a club or gym, your current membership (or active membership) may be heavy on men and these active young consumers, many of whom likely never really stopped coming to work out in person. On the opposite end of the spectrum are women and Boomers. Both have yet to return to the gym in real numbers, and Gen X began falling off again as soon as the latest COVID surge began in July. Unsurprisingly, these are the same groups that stopped working out at the gym at the beginning of the pandemic in much larger numbers than men and younger consumers, and they have stayed away. This latest COVID surge means they likely won’t be back anytime soon.

This greater conscientiousness around social distancing means that the longer that women and older gym-goers stay away, the more difficult it may become for gyms to balance the value equation that makes it worthwhile to come in. The group fitness classes that women used to gravitate toward in higher numbers than men are less appealing with the Delta variant being a more transmissible virus. For these people, the social environment that many still miss is not worth the risk when they have reliable solo or outdoor workout habits they’ve established over the last 18 months. Sad to say, but many women and older consumers may not be back until the pandemic is truly in check. And, even then, it will be a question of whether they’ve established at-home or outdoor fitness routines that are fulfilling enough to outweigh the benefits of rejoining or revisiting a gym.

Focus on Retaining Current Members

Because the regulations, social context and actual case counts related to the pandemic are highly variable across the United States currently, it is imperative to understand what your current clientele want from the gym, what they need in terms of safety and what trade-offs they are willing to make. Do your members want to keep group fitness but limit the number of pepole who can attend in-person? Do they want stricter policies or more enforcement around vaccinations and masking? Do they want to reduce the number of people in the club at any given time in order to work out safely without masks? These calculations will be different depending on the state of the pandemic in your location, local politics and regulations, and your specific clientele, but understanding them is the key to retaining not only members who have been with you all along but also those who may have just joined or returned.

High-Value Consumers

Gym members who also use digital fitness are high-value consumers with specific needs. The majority of those who use digital fitness are also gym members, to the tune of 61 percent. This has been stable for about a year. However, the number of brick-and-mortar gym members who also use digital fitness has been increasing, from 42 percent in second quarter 2020 to 51 percent in second quarter 2021. This group — gym members who also use digital fitness — are high-value fitness consumers. They’re young with higher incomes, urban and busy — more than two-thirds have children. They also skew male and are more active in a wider variety of sports and fitness pursuits than the average gym member, particularly team sports. And they are more likely to own the latest fitness technology, including fitness trackers, heart rate monitors and smart scales.

Because this group is so active, they have specific reasons for using the gym. They’re more likely than the average gym member to do group classes and personal training, and with so many dads, it should be no surprise that they are more likely to want 24-hour access and on-site childcare. Although this group works out frequently at home, the gym may also be a haven.

However, they are also more likely than the average member to value a useful website and app, which are key points of engagement for this group.

What’s the takeaway? Make sure your digital resources — streaming classes, virtual personal training sessions, fitness tracking, scheduling systems — are easy to access and use, and that they add convenience by bringing the gym to these customers where they are.

Loyal Consumers

Although the Delta variant may hinder women and older consumers’ return to in-person fitness, the consumers that have stuck with your club all along will likely remain. When looking at fitness and gym trends holistically since the start of the pandemic, it becomes clear that the greatest value in the near term will likely come from retaining the customers you already have and increasing their engagement across your business, including both in-person and via digital fitness. Digital fitness is here to stay and is a good investment for the future because it makes it easy to maintain the personal contact and community that gym members want from the club even if they can’t come in-person.

More about State of Our Health

Since 2018, State of Our Health (SOOH) has been continuously collecting data from 1,000 U.S. consumers aged 13 and up every month. The result is in-depth insights over time that uniquely examine trends that lie at the intersection of fitness and food. The surveys are completed online and take approximately 30 minutes. The data is nationally representative and balanced to U.S. Census targets on gender, age, household income, race/ethnicity and region. In-depth qualitative supplemental research is also conducted to add color and context to the quantitative data set. Qualitative methods vary according to topic, but include virtual in-depth interviews, diary studies and mobile ethnographic engagements.

The result of this is that SOOH is a reference point for uncovering the underlying truths and trends that propel health attitudes and behaviors. It is the largest and most comprehensive U.S. fitness, food and mindfulness tracker, offering an unparalleled depth and breadth of data informing insights into almost every facet of American health and wellness. Due to SOOH’s comprehensive and longitudinal design, it can answer almost any question about fitness, food, health or wellness, and can do so more accurately than can be achieved by looking at these topics in isolation or during a snapshot in time. The data can also be cut by key consumer subgroups of interest as needed. You can learn about SOOH, including the benefits of subscribing, by emailing [email protected].